The acquisition brings Quintillion’s high-capacity broadband network into the Grain network of broadband infrastructure and communications businesses.

"Alaska is uniquely positioned to provide geostrategic advantage in bolstering our country's defence capabilities—which means Quintillion, under Grain's management, will play a critical role in boosting national defence," said George Tronsrue III, CEO at Quintillion.

"Having recently secured our latest national security agreement, the Quintillion team is thrilled about partnering with Grain to expedite closing the digital divide and accelerating the pace with which we connect more Alaskans to each other and to the rest of the world."

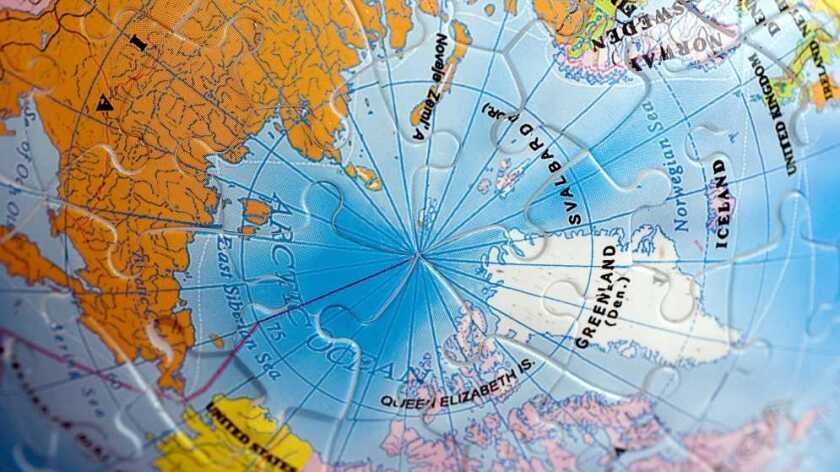

Quintillion sells broadband connectivity, satellite ground station, and edge processing services to government and commercial telecoms providers in the North American Arctic.

In June 2023, Quintillion was awarded $89 million through the National Telecommunications and Information Administration's Middle Mile Broadband Infrastructure Grant Program to provide redundant middle-mile backhaul capability for Alaska.

"The Grain team is excited to get to work alongside the talented leadership team at Quintillion," said Chad Crank, managing director at Grain.

"We believe in the Company's distinct competitive advantage and its unparalleled market position and look ahead to expanding its presence in Alaska and the North American Arctic."

Bank Street Group served as exclusive financial advisor to Quintillion and Cooper Investment Partners, and Alston & Bird and Morgan, Lewis & Bockius served as legal advisors to Grain and Quintillion, respectively.

“I want to express my appreciation to the Bank Street team for all of their counsel, persistence and effort,” said Adam Murphy, partner, Cooper Investment Partners.

“The process led to an experienced new investor for the company which will allow it to capitalise on the growth opportunities it has identified and produced a great result for the shareholders and management team."