The merger means that Telesat’s shares will be traded on both Nasdaq – where Loral’s shares are already traded – and the Toronto Stock Exchange.

Telesat said in a filing with the Securities and Exchange Commission (SEC), the US financial regulator, this week: “We have commenced the development of what we believe will be the world’s most advanced constellation of low Earth orbit (LEO) satellites and integrated terrestrial infrastructure, called Telesat Lightspeed – a platform designed to revolutionize the provision of global broadband connectivity.” The project is costed at US$5 billion.

The move means that the LEO market is getting increasingly competitive, with SpaceX’s Starlink already in operation, OneWeb about to go into service within weeks, and Amazon’s Project Kuiper now expected to be in service with two test satellites in 2022 and the rest to follow over the following seven years.

This week’s Telesat SEC filing added: “Telesat Lightspeed has the potential to transform global satellite and terrestrial communications industries, dramatically increasing the company’s addressable market from approximately US$18 billion to approximately $365 billion and significantly expanding its growth potential.”

Telesat said that it will benefit from its “historically strong and stable” business that uses 15 geostationary (GEO) satellites, “and, by continuing to develop and deploy Telesat Lightspeed, capitalize on the growing demand for global broadband connectivity”.

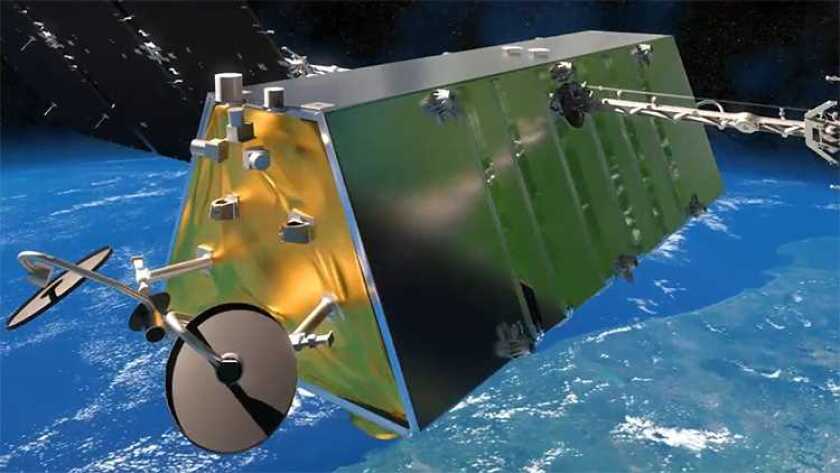

Telesat says Lightspeed will use 298 interconnected LEO satellites “coupled with a sophisticated and integrated terrestrial infrastructure to create a fibre-like broadband network from the sky for commercial and government users worldwide”.

That count of fewer than 300 satellites, which will operate at 1,000km above the Earth, means Lightspeed’s network will be smaller than any of its rivals. OneWeb plans an initial 648 satellites, to be in service in early 2022; SpaceX plans thousands of Starlink satellites; and Amazon has a licence for 3,236 Kuiper satellites.

The Lightspeed fleet will provide “full global coverage while concentrating capacity over geographic regions of highest demand”, says Telesat in the SEC filing. “Additional satellites and ground facilities can be added to the network to meet increased user demand as and when required.”

The company said it already has US$663 million worth of revenue commitments, including a contract with the government of Canada. In addition, the Canadian province of Ontario has purchased a $109 million dedicated Telesat Lightspeed capacity pool “to be made available at substantially reduced rates to Canadian internet service providers and mobile network operators”.

And in August 2021 the government of Canada said it would lend C$709 million to the project and take out an equity investment of C$650 million – a total of C$1.4 billion (US$1.1 billion).