The ILEC business, currently operating under the CenturyLink brand, includes its consumer, small business, wholesale and copper-served enterprise customers and assets.

While the $7.5 billion price tag includes a debt assumption of approximately $1.4 billion and according to the company is "subject to working capital and various other purchase price adjustments".

"This transaction is an important step in our continued efforts to transform Lumen and drive future growth for our company," said Jeff Storey (pictured), president and CEO at Lumen.

"We are pleased with the attractive valuation we received for these assets, which highlights the overall value of Lumen's extensive asset portfolio. Apollo Funds will receive a great business with a strong customer base, dedicated employees, and a platform for future growth."

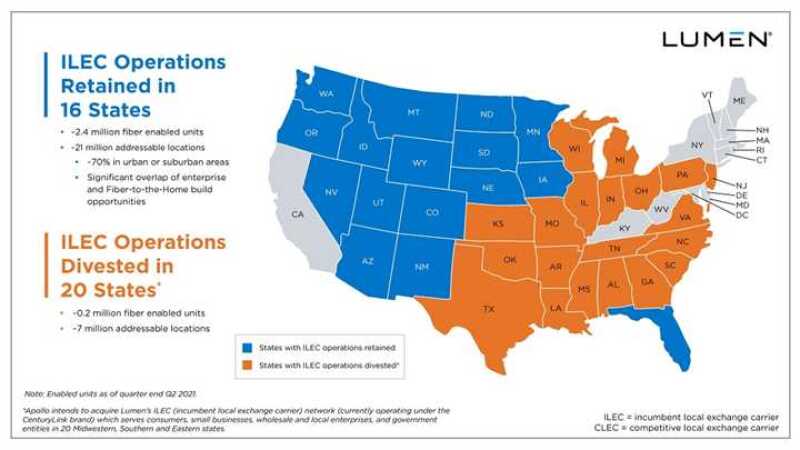

Under the terms of the deal, Lumen will retain its ILEC assets in 16 states, as well as its national fibre routes and competitive local exchange carrier (CLEC) networks as "it delivers the fastest, most-secure platform for next-gen business applications and data".

Specifically, the acquired assets in the 20 states includes a local fibre and copper network; broadband and voice for consumer, enterprise and wholesale customers; fibre and copper connectivity to enabled buildings; connectivity to tower sites; and central offices.

In turn, Apollo Funds will deliver a robust, scaled local network, as well as the operations and back-office support to meet the accelerating demand for high-bandwidth connectivity and fibre technology.

"The team at Lumen has built a great business and we see an incredible opportunity to provide leading edge, fibre-to-the-home broadband technology to millions of its business and residential customers," said Aaron Sobel, private equity partner at Apollo.

"Our investment will help accelerate the upgrade to fibre optic technologies, and we are excited to have such a high-calibre management team ready to bring faster and more reliable internet service to many rural markets traditionally underserved by broadband providers."

The transaction is due to close in the second half of 2022, subject to customary closing conditions and regulatory approvals.

In late July, Lumen Technologies said it was selling off its Latin American business for US$2.7 billion.