The transaction will enhance Digital Realty’s ability to serve top US data centre metro areas. DuPont Fabros' portfolio, which is concentrated in top US data centre metro areas across Northern Virginia, Chicago and Silicon Valley, will help grow Digital Realty's existing footprint of 145 properties across 33 global metropolitan areas.

The two companies' operating models are highly complementary, and the combined organisation is expected to provide the most comprehensive product offering in the data centre sector.

"This strategic and complementary transaction significantly enhances Digital Realty's ability to support the growth of hyper-scale users in the top US data centre metro areas, while providing meaningful customer and geographic diversification for DuPont Fabros," said A. William Stein, CEO of Digital Realty, which supports the data centre, colocation and interconnection strategies of more than 2,300 firms across its data centre portfolio throughout North America, Europe, Asia and Australia.

"The combination is expected to generate both operating and financial benefits, and I'd like to congratulate Scott Peterson, Mark Walker and their team on successfully negotiating the largest transaction in our company's history, a combination that we believe will enhance our ability to create significant long-term value for both sets of shareholders."

Digital Realty acquired Telx Group for approximately $1.89 billion in 2015, which COO Jarrett Appleby recently told Capacity got the company "significantly going as a colocation and interconnection leader".

DuPont Fabros' 12 purpose-built, in-service data centres will significantly expand Digital Realty's hyper-scale product offering and improve its ability to meet the rapidly growing needs of cloud and cloud-like customers, in addition to enterprise customers undertaking the shift to a hybrid cloud architecture. Conversely, the transaction enables DuPont Fabros to address a broader set of customers' data centre requirements, with the addition of Digital Realty's colocation and interconnection product offerings.

The rapid growth of cloud continues to drive heavy investment in data centre facilities, while the combination of global and local requirements helps to fuel industry consolidation. According to a report by Synergy Research Group in April, this has helped the US wholesale market to grow twice as rapidly as retail colocation.

“Colocation is an increasingly global market but also demands highly localised services focused on data centre facilities close to clients in key economic hubs. This combination of global and local factors has been a major factor in driving the ongoing industry consolidation,” said John Dinsdale, a chief analyst and research director at Synergy Research Group.

DuPont Fabros' roster of blue-chip customers will further enhance the credit quality of Digital Realty's existing customer base. On a combined basis, investment grade or equivalent customers will represent more than 50% of total revenue. The transaction also significantly reduces DuPont Fabros' customer concentration. The combined company's top three customers will account for approximately 18% of revenue compared to 57% for the top three customers of DuPont Fabros on a standalone basis.

DuPont Fabros' six data centre development projects currently under construction are 48% pre-leased and represent a total expected investment of approximately $750 million, and amount to roughly a 26% expansion of its standalone critical load capacity. These projects are located in Ashburn, Chicago, Santa Clara and Toronto, all metro areas where Digital Realty has an existing presence. These six projects are expected to be delivered over the next 12 months, representing a solid pipeline of future growth potential. In addition, DuPont Fabros owns strategic land holdings in Ashburn and Oregon, which will support the future delivery of up to 163MW of incremental capacity, along with 56 acres of land recently acquired in Phoenix.

Christopher P. Eldredge, DuPont Fabros' president and CEO, added: "We are excited to deliver this compelling transaction to our shareholders and execute upon two of the strategic objectives embodied in our corporate vision – diversifying our customer base and expanding our geographic presence. As part of Digital Realty, our shareholders will continue to realise the benefits of our high-quality portfolio, with the added benefits of belonging to an even greater data centre network with a truly global footprint and a well-diversified customer base. We also believe our shareholders will greatly benefit from Digital Realty's investment grade balance sheet and more attractive cost of capital. We look forward to working closely with the Digital Realty team over the coming months to close the transaction and bring our two companies together."

Transaction details

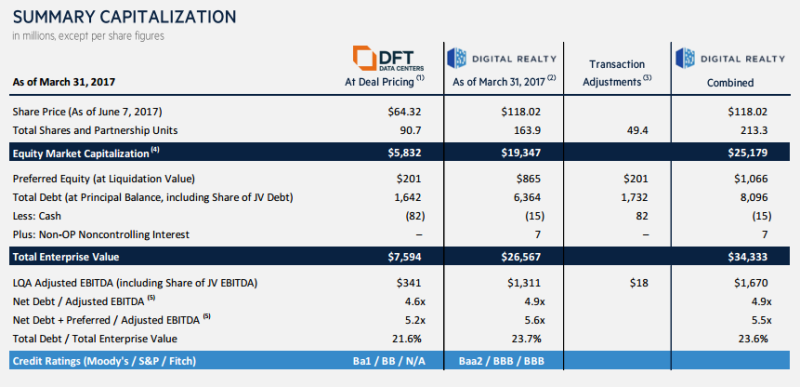

The fixed exchange ratio represents a total enterprise value of approximately $7.6 billion, including $1.6 billion of assumed debt and excluding transaction costs. Digital Realty has obtained a fully committed bridge loan facility from BofA Merrill Lynch and Citigroup which will be available, if needed, to finance the transaction. The debt assumed in the transaction is expected to be permanently refinanced with a combination of investment grade corporate bonds and other financings. The transaction has been unanimously approved by the boards of directors of both Digital Realty and DuPont Fabros.

Under the terms of the agreement, DuPont Fabros shareholders will receive a fixed exchange ratio of 0.545 Digital Realty shares per DuPont Fabros share, for a transaction valued at approximately $7.6 billion in enterprise value.

The combination of the two companies is expected to create an opportunity to realise up to $18 million of annualised overhead savings, resulting from both companies' complementary business operations. Upon closing, the transaction is expected to be immediately accretive to financial metrics, and is expected to further improve balance sheet strength.

Closing the deal

The transaction is expected to close in the second half of 2017 and is subject to the approval of DuPont Fabros and Digital Realty shareholders and other customary closing conditions.