Dell’Oro admits in its latest report that growth was even lower in 2022 than the 4% it forecast a year ago.

Report author Stefan Pongratz said: “In addition to more challenging comparisons in the advanced 5G markets and the supplier exits in Russia, the strengthening [US dollar] weighed on the broader telecom equipment market.”

Supply issues also impacted the market negatively during the first half of 2022, but improved “somewhat” in the second half of the year, he adds.

The slowing down follows “four consecutive years of modest telecom equipment growth” in six sectors that Dell’Oro is tracking – broadband access, microwave and optical transport, mobile core network (MCN), radio access network (RAN), and service provider router and switch.

Broadband access revenues surged in 2022, says the report. However, this double-digit growth was offset by stable or low-single-digit growth across the other five segments.

There was strong growth in North America and central and Latin America, but “more challenging conditions” in Europe, the Middle East and Africa, and the Asia Pacific.

“With China growing around 4%, we estimate global telecom equipment revenues excluding China increased around 3% in 2022,” said Pongratz.

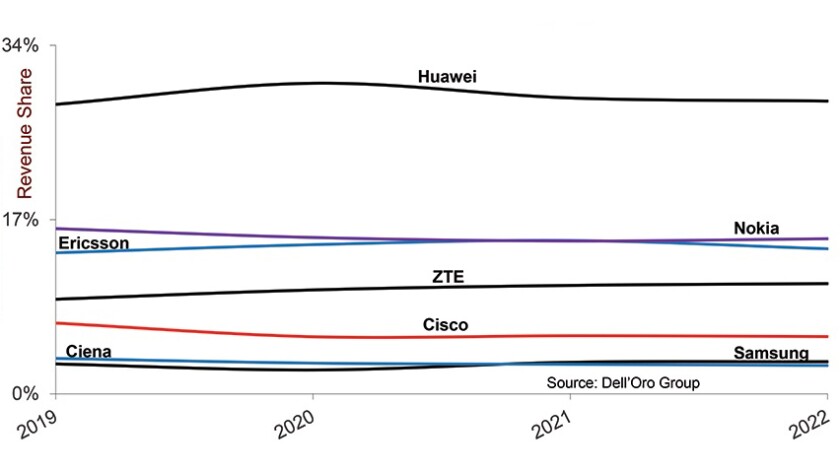

Huawei (see chart) still leads the global telecoms equipment market, says Dell’Oro, “in part because Huawei remains the number one supplier in five out of the six telecom segments we track”, said Pongratz.

“At the same time, Huawei has lost some ground outside of China. Still, Nokia, Ericsson, and Huawei were the top three suppliers outside of China in 2022, accounting for around 20%, 18%, and 18% of the market, respectively.”

Dell’Oro said it “believes there is more room left in the tank”. The analyst team is forecasting the overall telecoms equipment market to increase by 1% in 2023 and record a sixth consecutive year of growth.