Amazon Web Services (AWS) and Microsoft Azure are leading the growth, but smaller players are still growing at 30% year-on-year.

Canalys gives the higher figure for spending but a slightly lower figure for growth. “Cloud infrastructure services spending grew 35% to $41.8 billion in the first quarter of 2021,” it says.

Synergy Research Group’s figure was $39 billion, just a shade lower than that from Canalys, but said annual growth over the first quarter of 2020 was 37%, two percentage points higher than Canalys’s estimate.

“Amazon and Microsoft have earned their leadership positions as they focus aggressively on growing their cloud services, quarter after quarter, year after year, said John Dinsdale, a chief analyst at Synergy.

“They continue to invest billions of dollars every quarter in expanding their global data centre footprint, while at the same time enhancing their cloud service portfolios.”

Canalys research analyst Blake Murray said: “Cloud emerged as a winner across all sectors over the last year, basically since the start of the Covid-19 pandemic and the implementation of lockdowns. Organisations depended on digital services and being online to maintain operations and adapt to the unfolding situation.”

His figures show that Amazon Web Services (AWS) “was the leading cloud service provider” in the first quarter of 2021, “growing 32% on an annual basis to account for 32% of total spend”. Canalys said: “Microsoft Azure grew 50% for the third consecutive quarter,” taking a 19% market share in the first quarter of the year.

Dinsdale at Synergy said of AWS and Microsoft: “These two don’t have to spend too much time looking in their rearview mirrors and worrying about the competition. However, that is not to say that there aren’t some excellent opportunities for other players.”

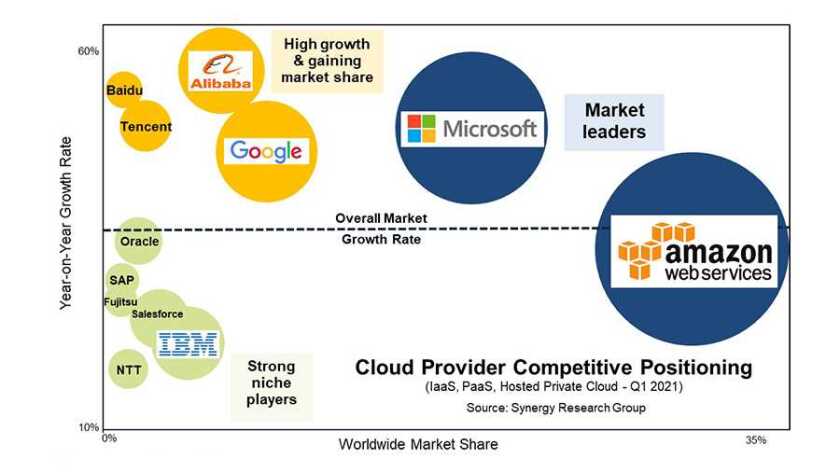

Synergy’s research (see picture) shows that three Chinese companies — Alibaba, Baidu and Tencent — show faster growth than the US giants, but still have smaller market shares.

Dinsdale said: “Taking Amazon and Microsoft out of the picture, the remaining market is generating over $18 billion in quarterly revenues and growing at over 30% per year. Cloud providers that focus on specific regions, services or user groups can target several years of strong growth.”

Canalys’s Murray said there is more to come for the cloud industry: “Though 2020 saw large-scale cloud infrastructure spending, most enterprise workloads have not yet transitioned to the cloud. Migration and cloud spend will continue as customer confidence rises during 2021. Large projects that were postponed last year will resurface, while new use cases will expand the addressable market.”

Canalys chief analyst Matthew Ball elaborated on growth opportunities: “Geographic expansion for data sovereignty and to improve latency, either via full-region deployment or a local city point of presence, is one area of focus for the cloud service providers.”