A new report, from Rethink Technology Research’s director Caroline Gabriel, says that spending will reach US$32.3 billion “despite overhype and uncertainty over which standards will prevail”.

She writes in the latest report: “Open RAN deployments will occur rapidly across all sectors but will accelerate fastest in small cell environments, especially greenfield roll-outs, rather than in macro and micro RANs.”

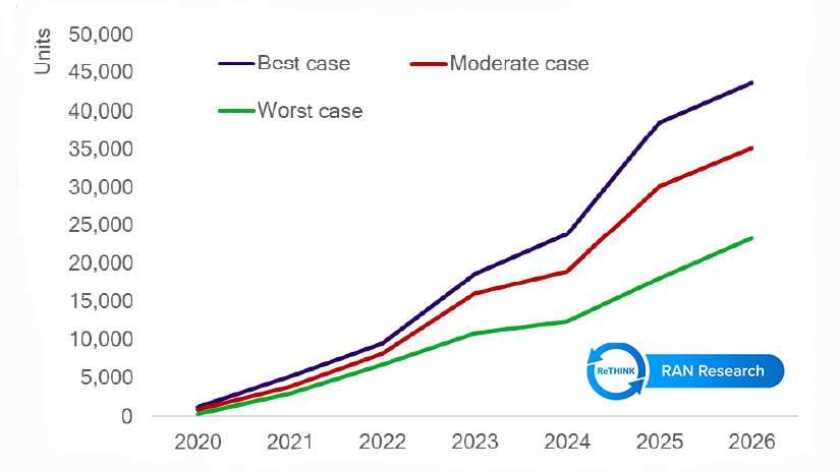

The report, Open RAN adoption patterns and forecast 2020-2026, is from RAN Research, the wireless analytics arm of Rethink Technology Research, highlights the key role alternative and enterprise deployers will play in driving open RAN in many markets, including specialized divisions within mobile network operators (MNOs) and telcos.

In 2020-23, only 17% of established MNOs will deploy an open RAN for any purpose, while 39% of alternative and greenfield deployers will adopt it fully in this early phase. “Enterprise small cell networks will be a particularly strong driver and proving ground for open RAN,” says Gabriel.

Her report points out that “there is considerable momentum behind open, disaggregated RAN architectures in 2020”, and that “operators are looking for more cost-effective and agile networks, and access to broader ecosystems and innovation bases to facilitate their move to virtualised platforms”.

She warns that “there is also a significant dose of hype, and some operators are calling for a reality check in terms of how soon the emerging open platforms – and suppliers – will be ready for the extraordinary demands of a full-scale 5G macro network with a heavy traffic load coupled with very low latency and very high quality of service requirements”.

Gabriel and RAN Research talked to 107 service providers – 78 MNOs and 29 other cellular network deployers – about their open RAN drivers, barriers and investment intentions over the coming five to six years.

Key drivers “were led by the need for simplicity of deployment, followed by access to innovation and multivendor interoperability”, she writes. “Reduction in total cost of ownership was only in fourth place.”

The report identifies barriers that might delay deployment by at least a year. “The most important were concerns about robustness and reliability; and that implementation costs would be high.”